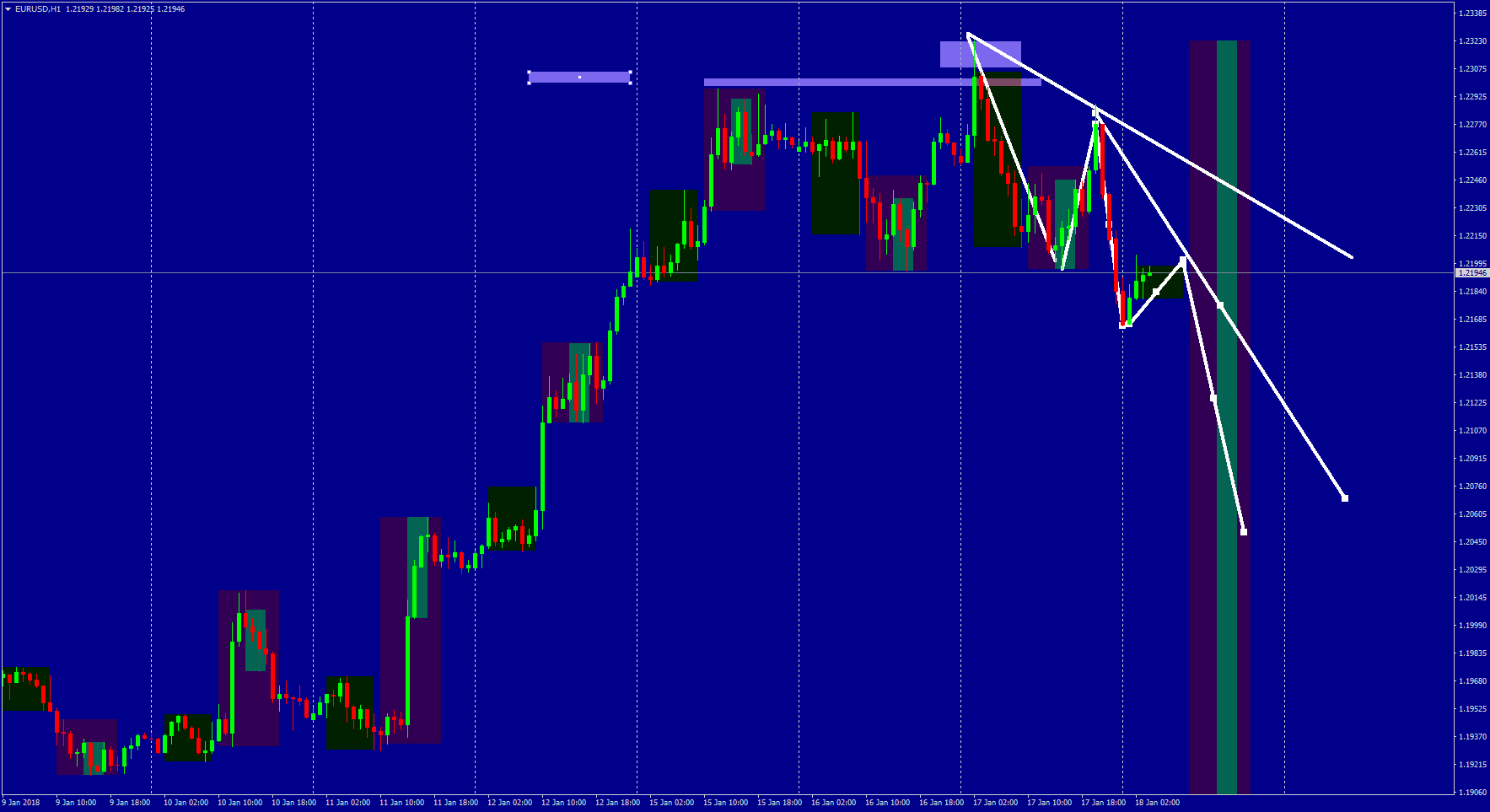

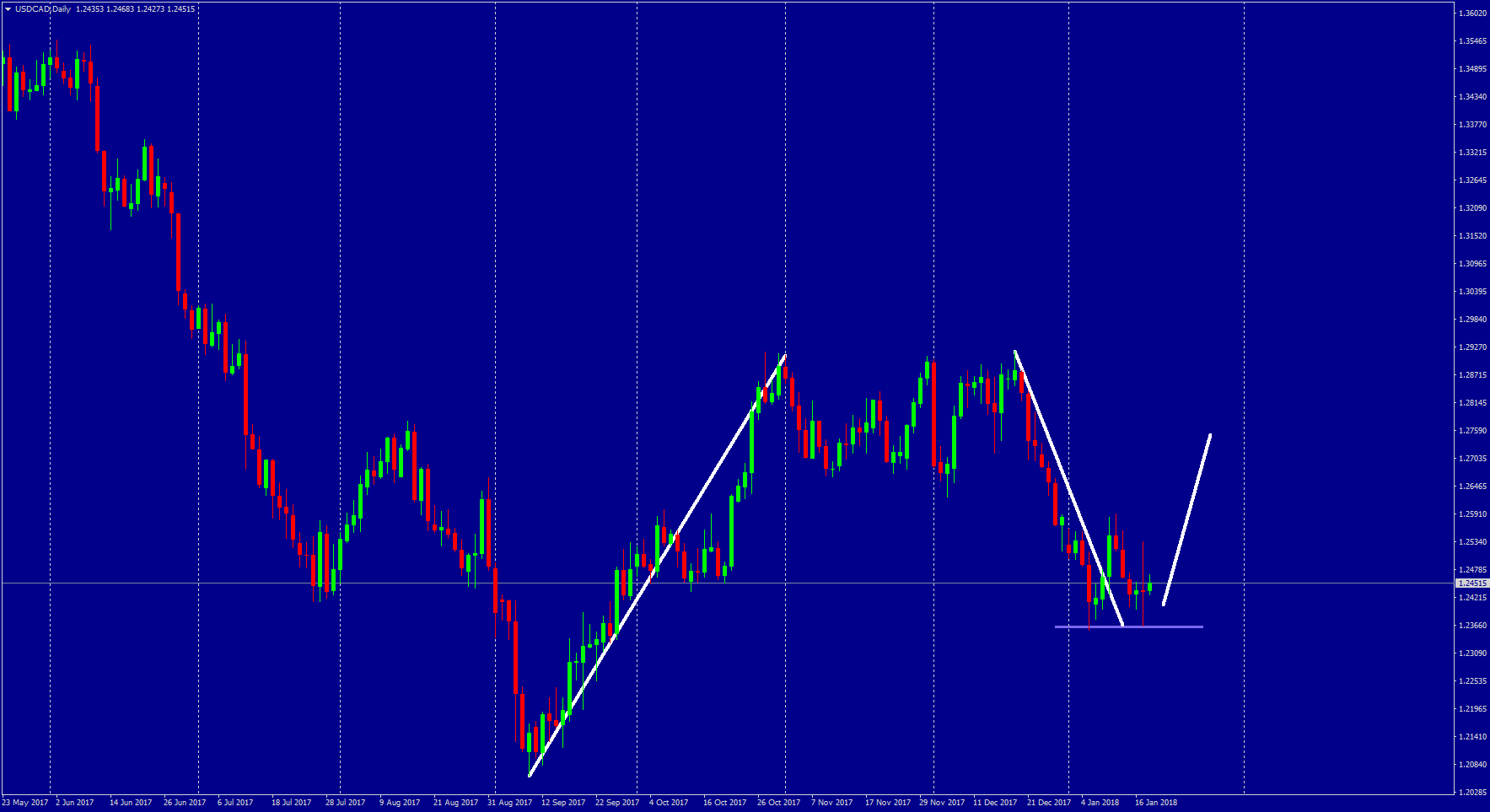

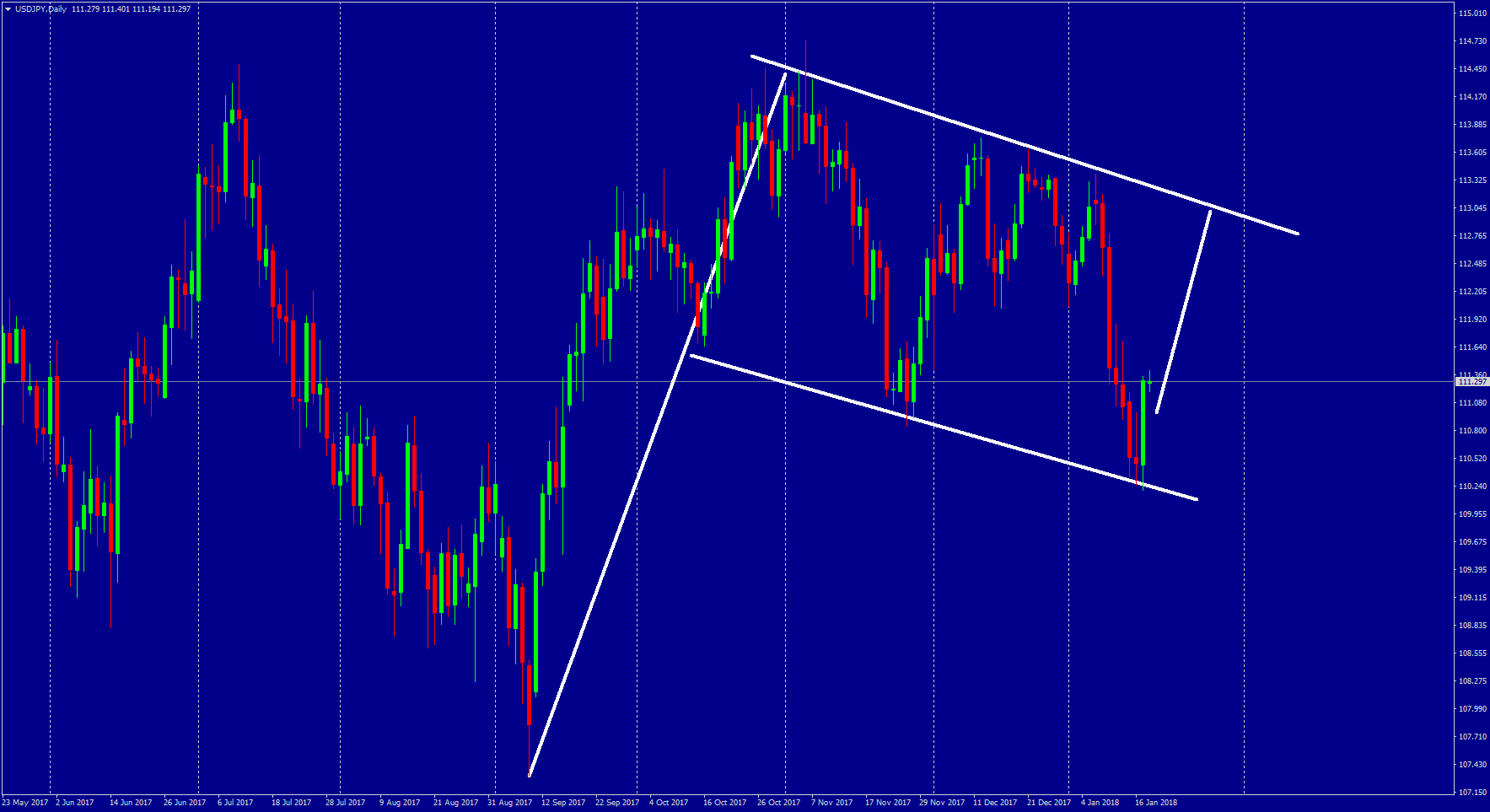

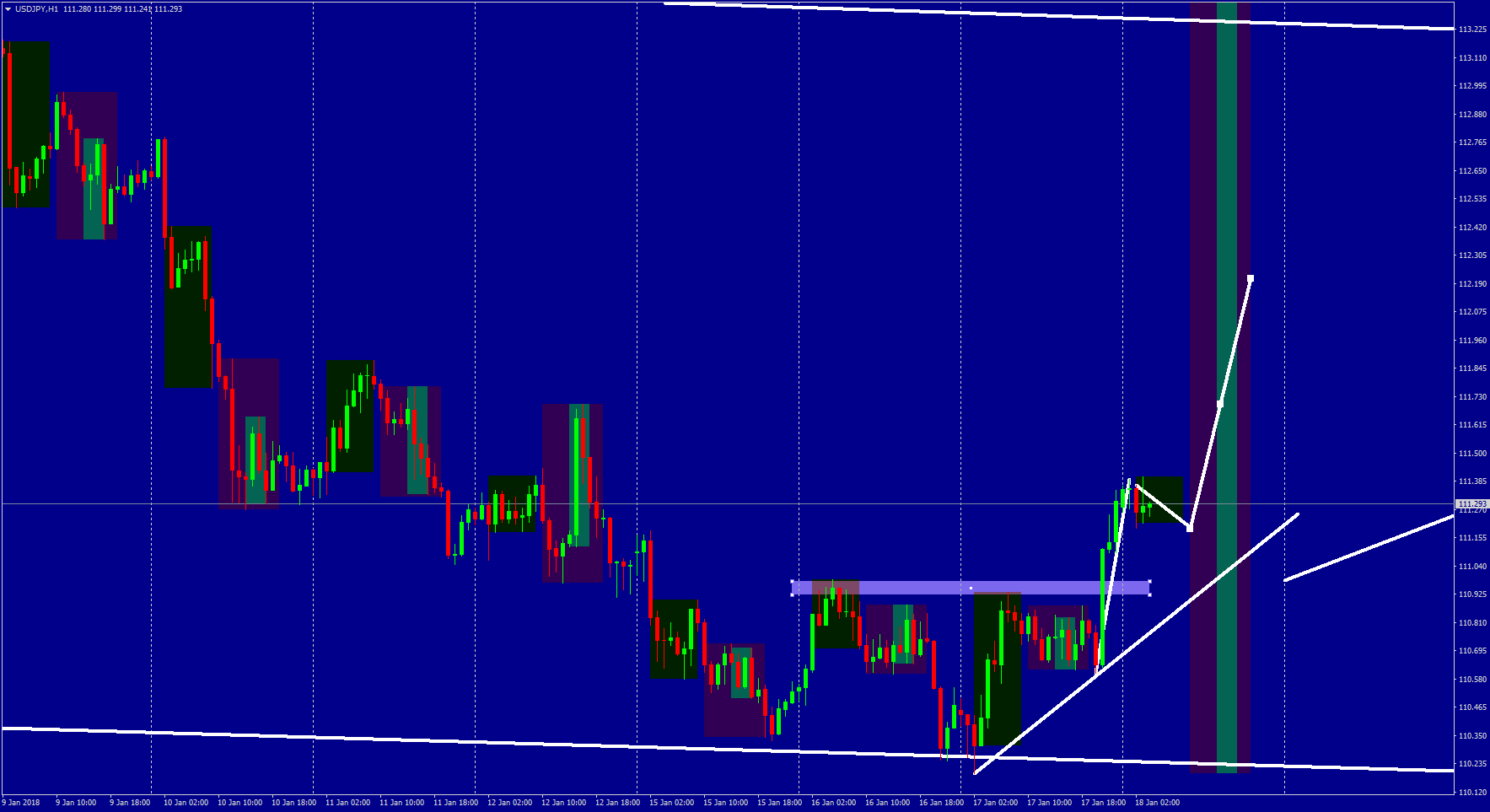

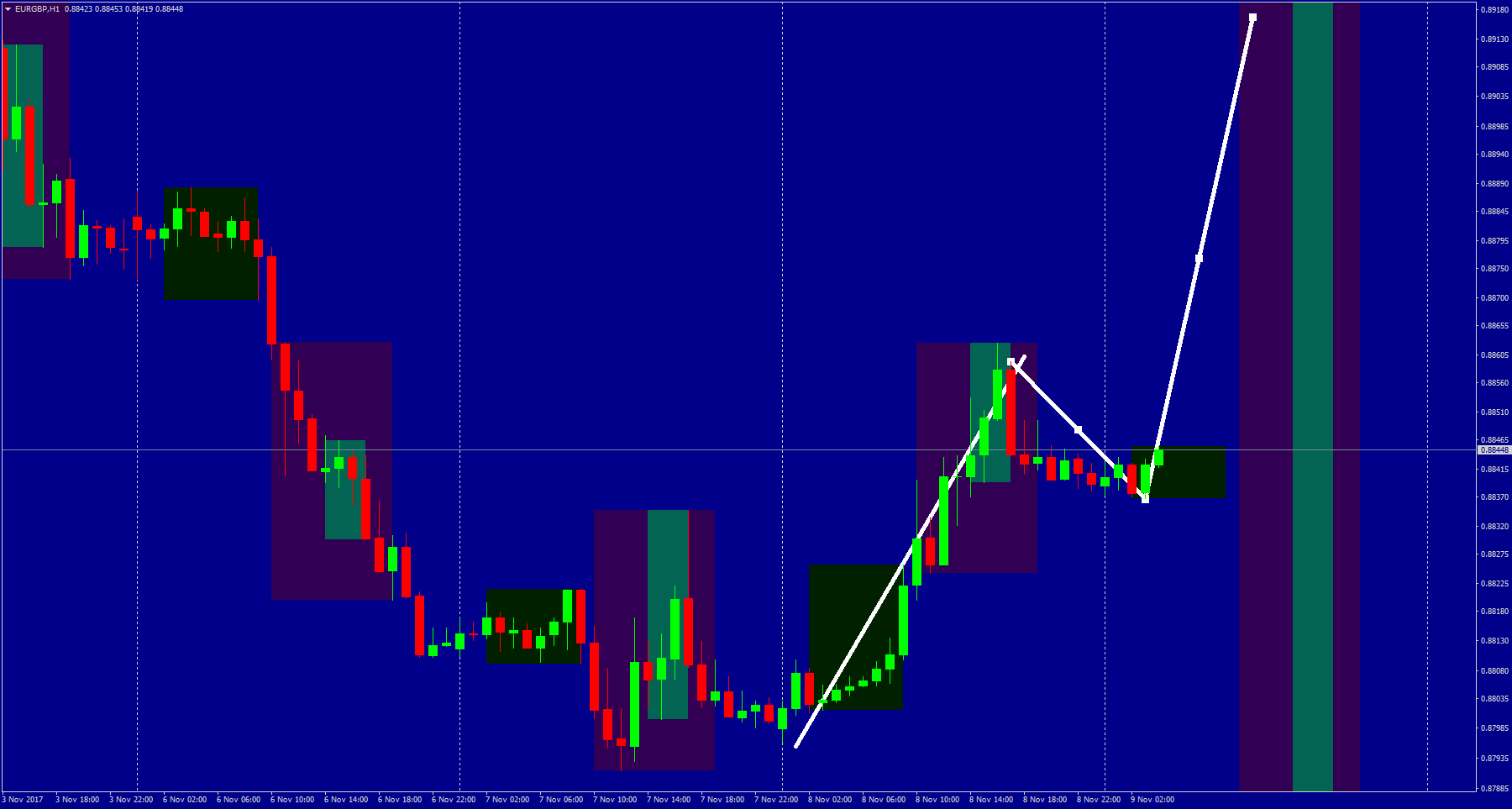

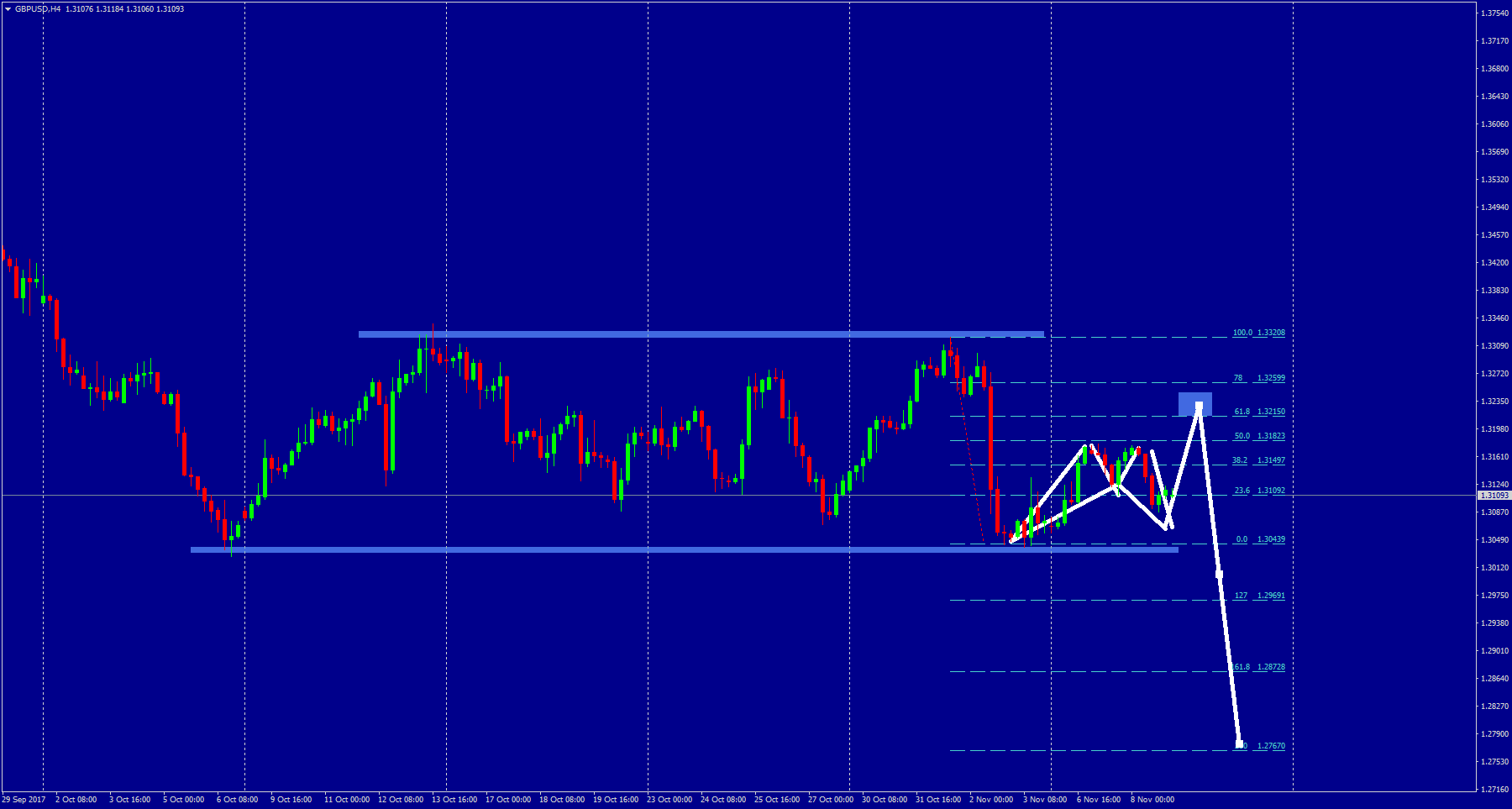

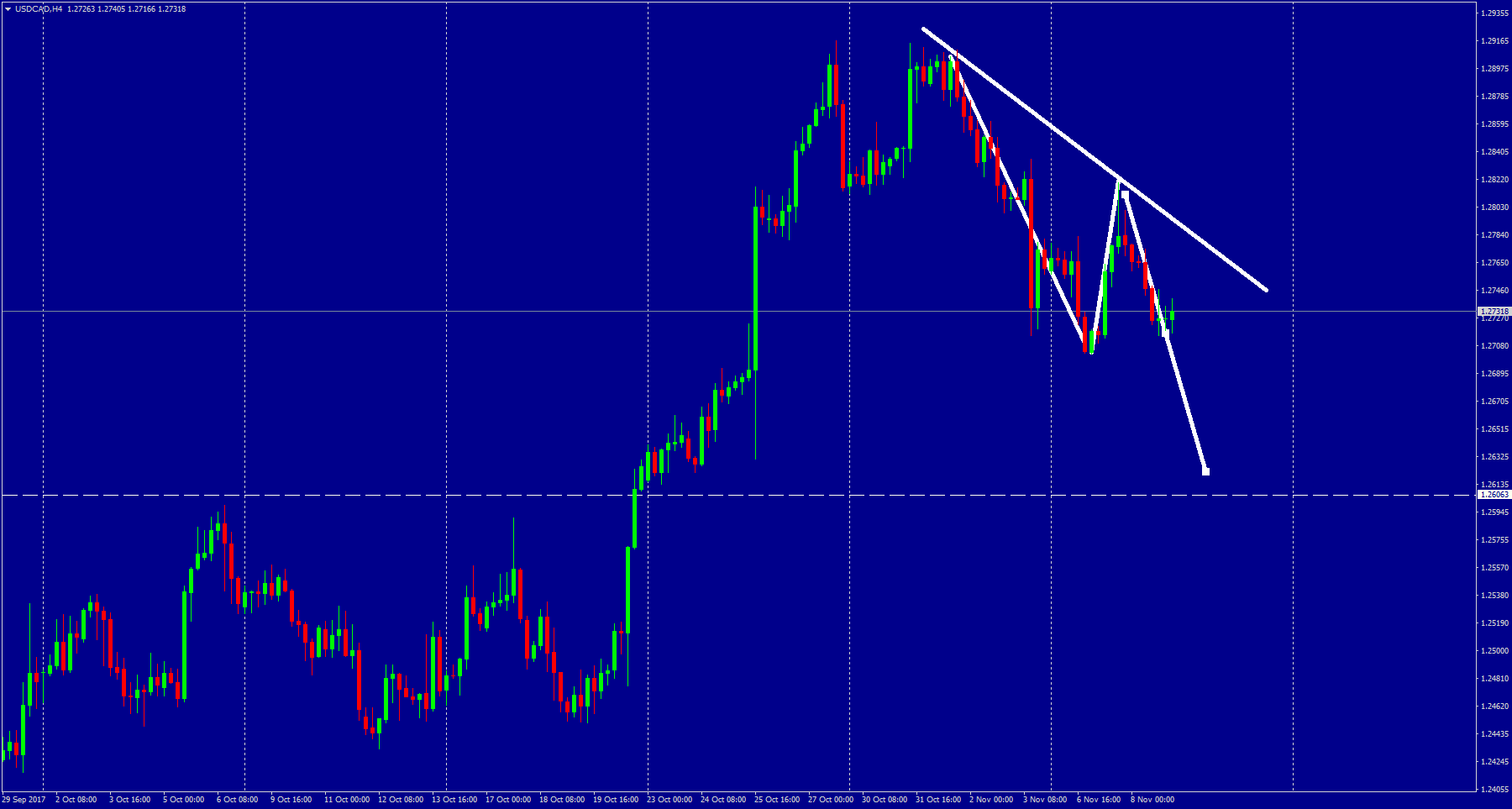

Yesterday(Trade 1), my trade missed the target by under a pip. It then shot back up to stop me out at break even. Had I not made the target a round number ($) the trade would have been profitable.

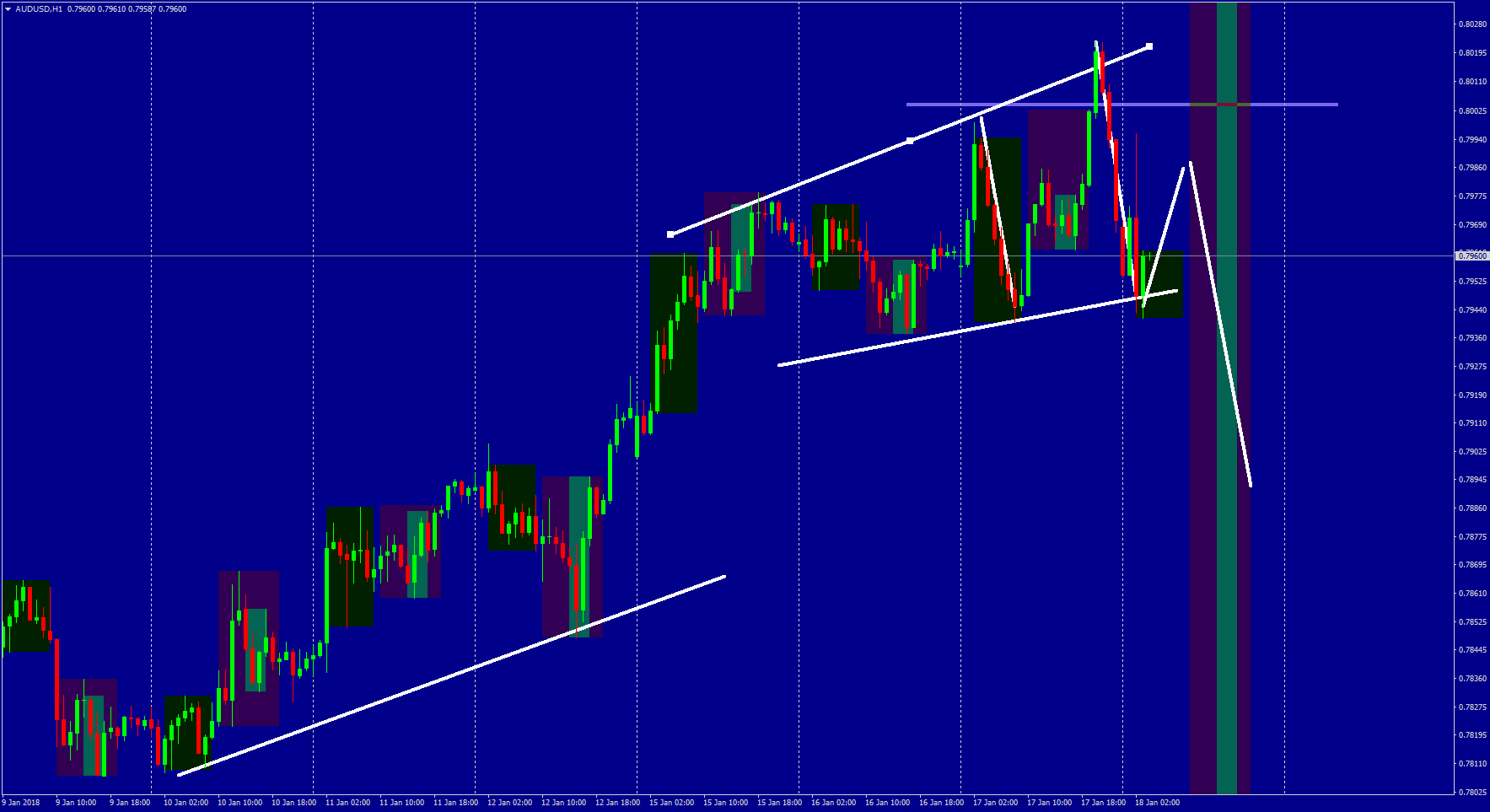

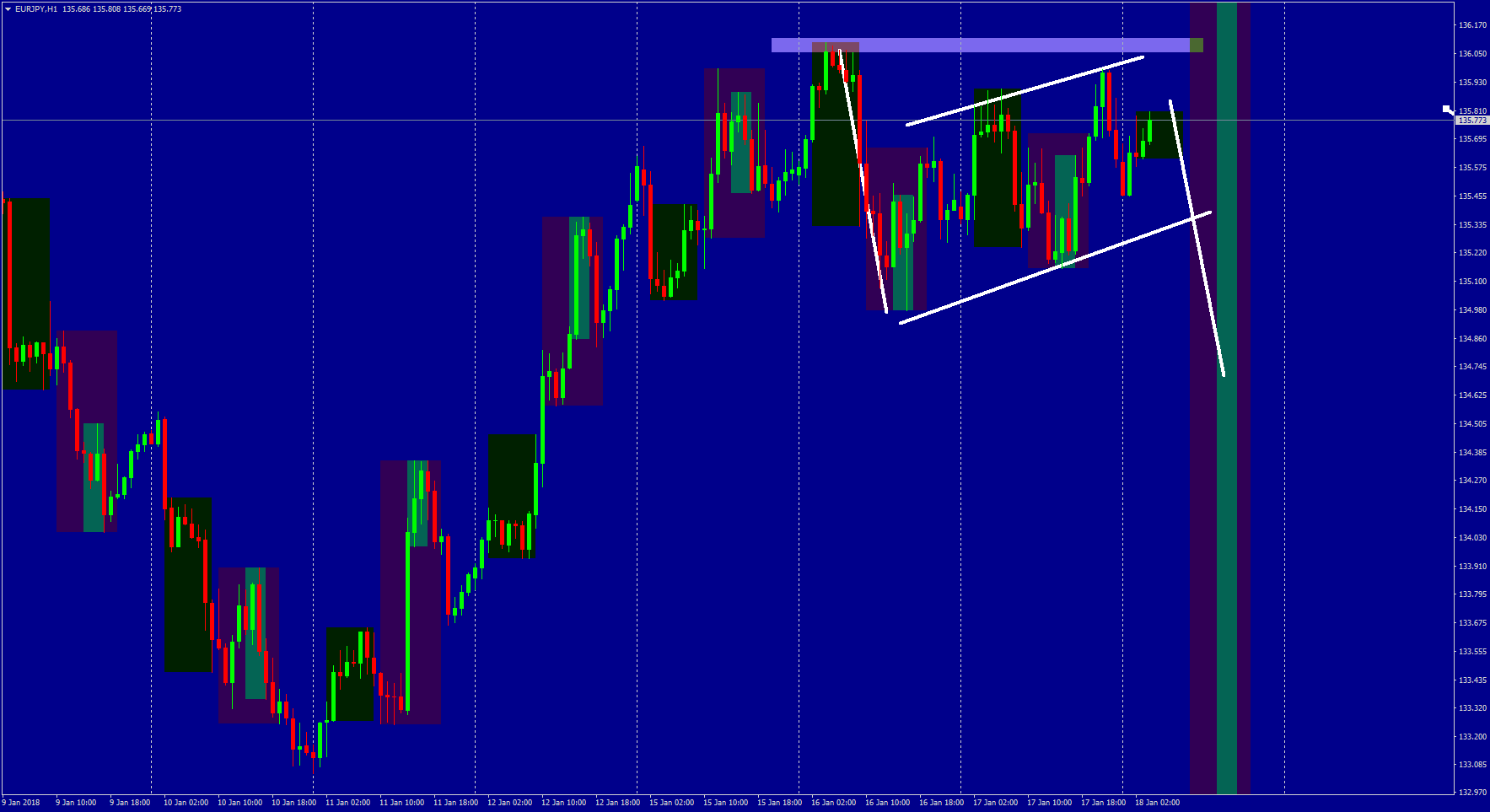

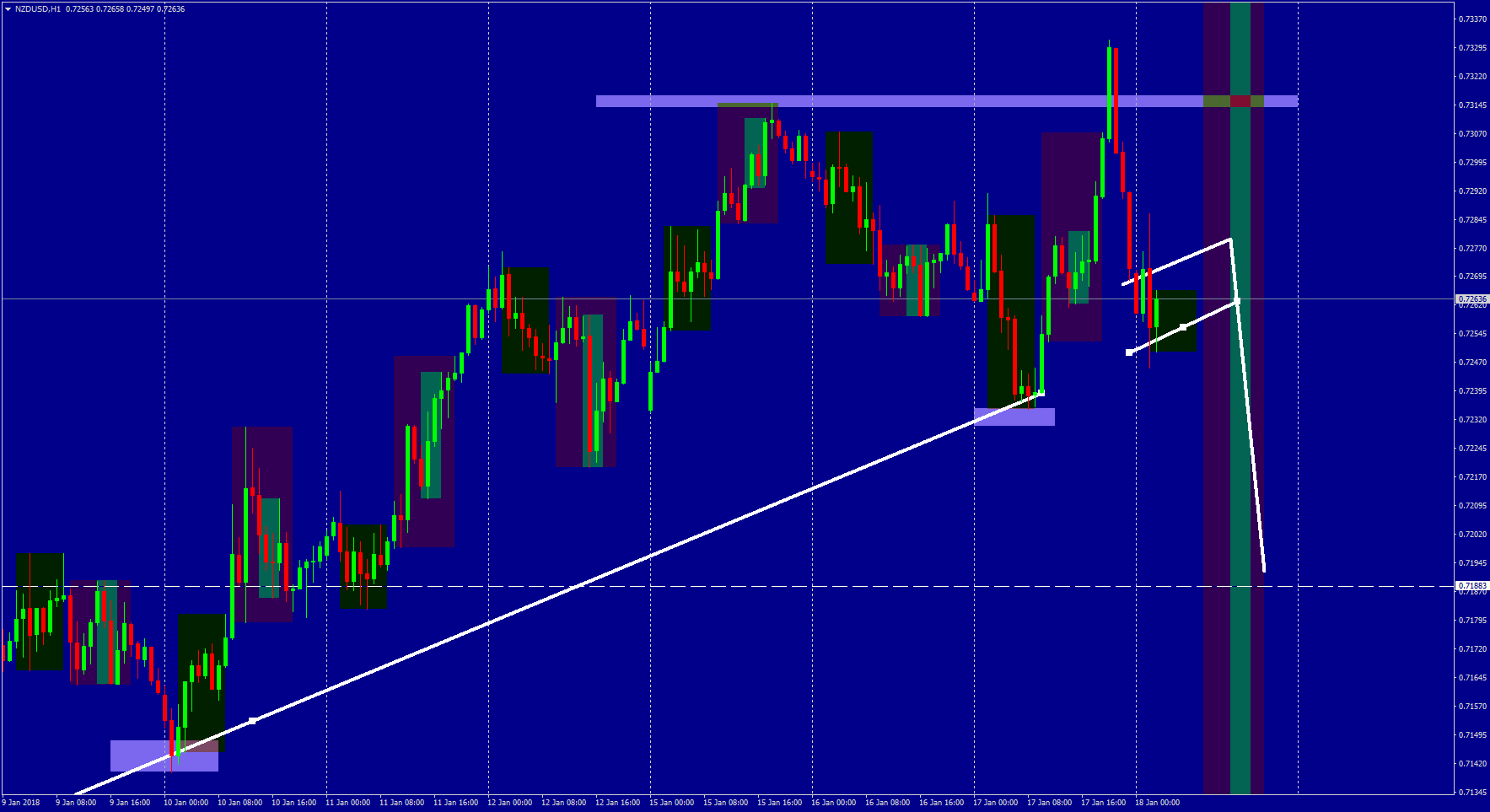

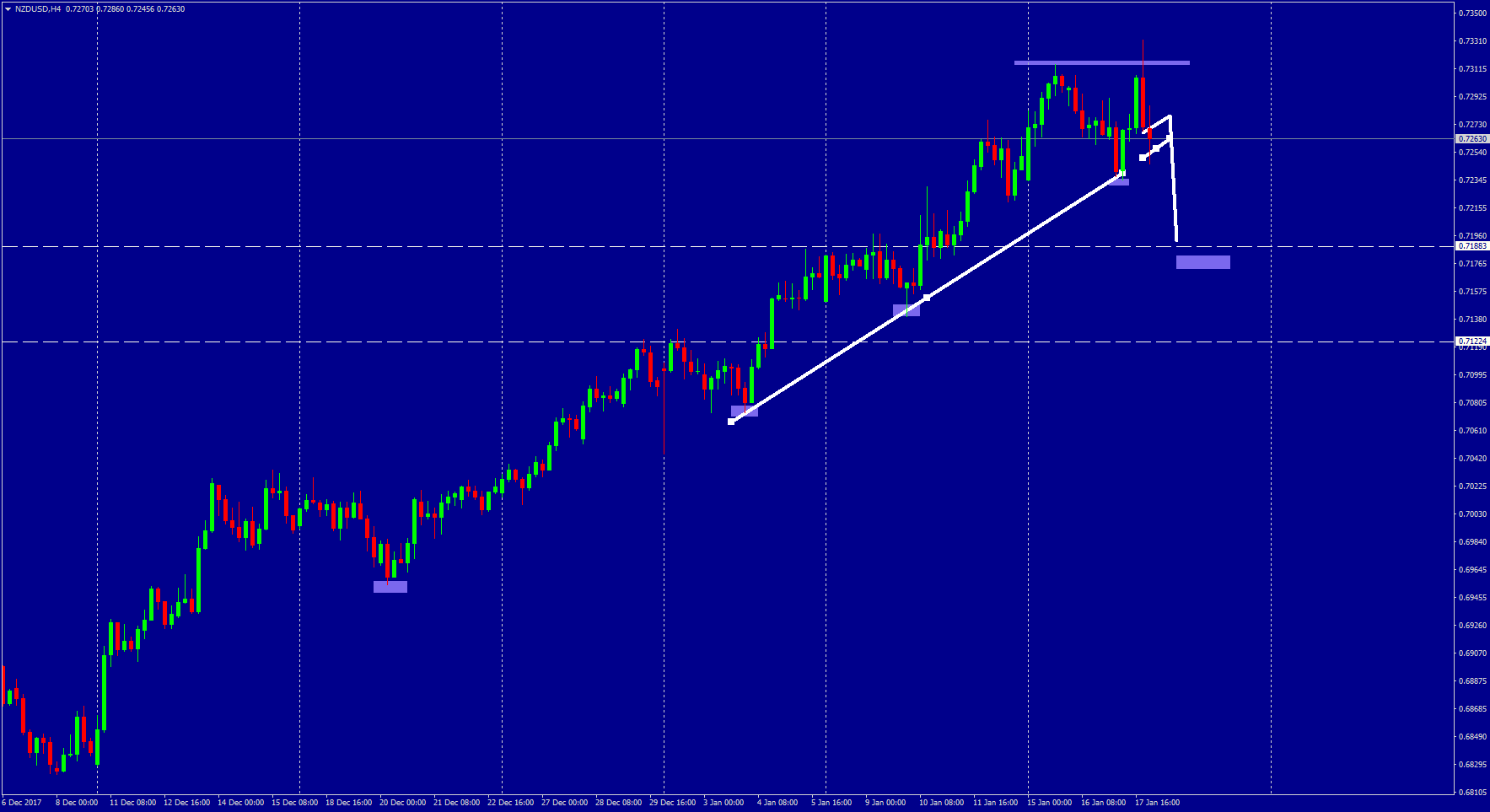

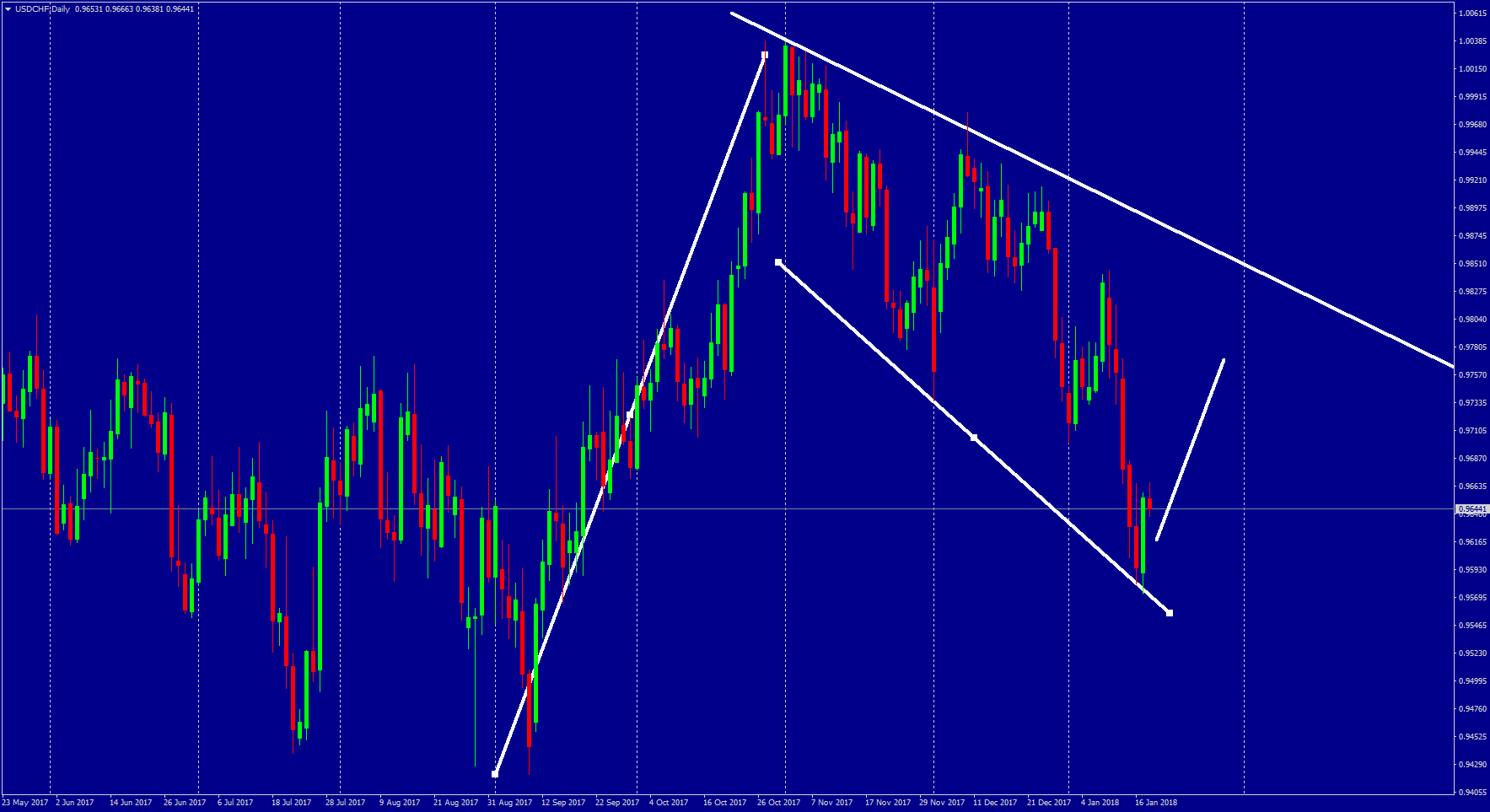

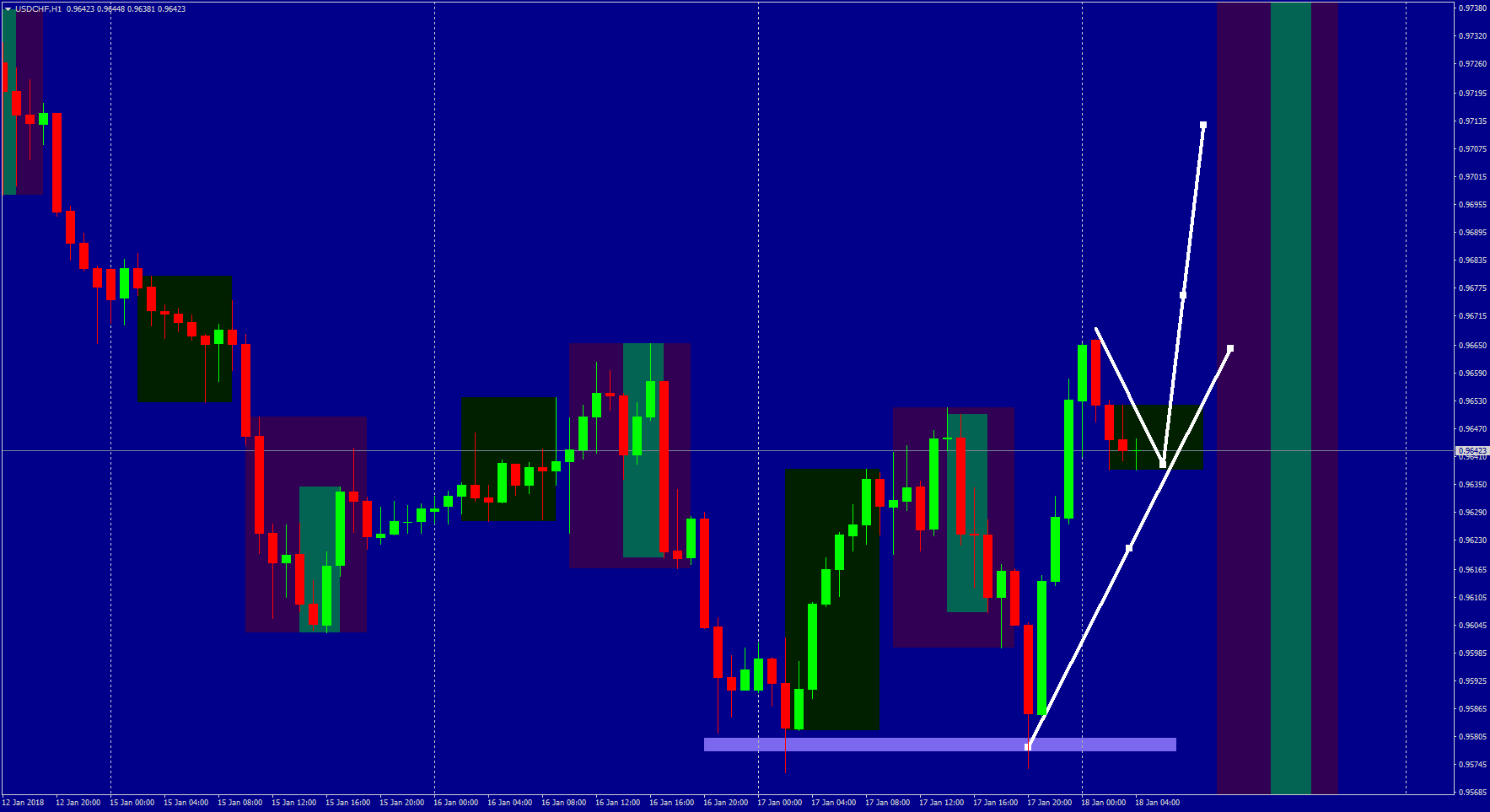

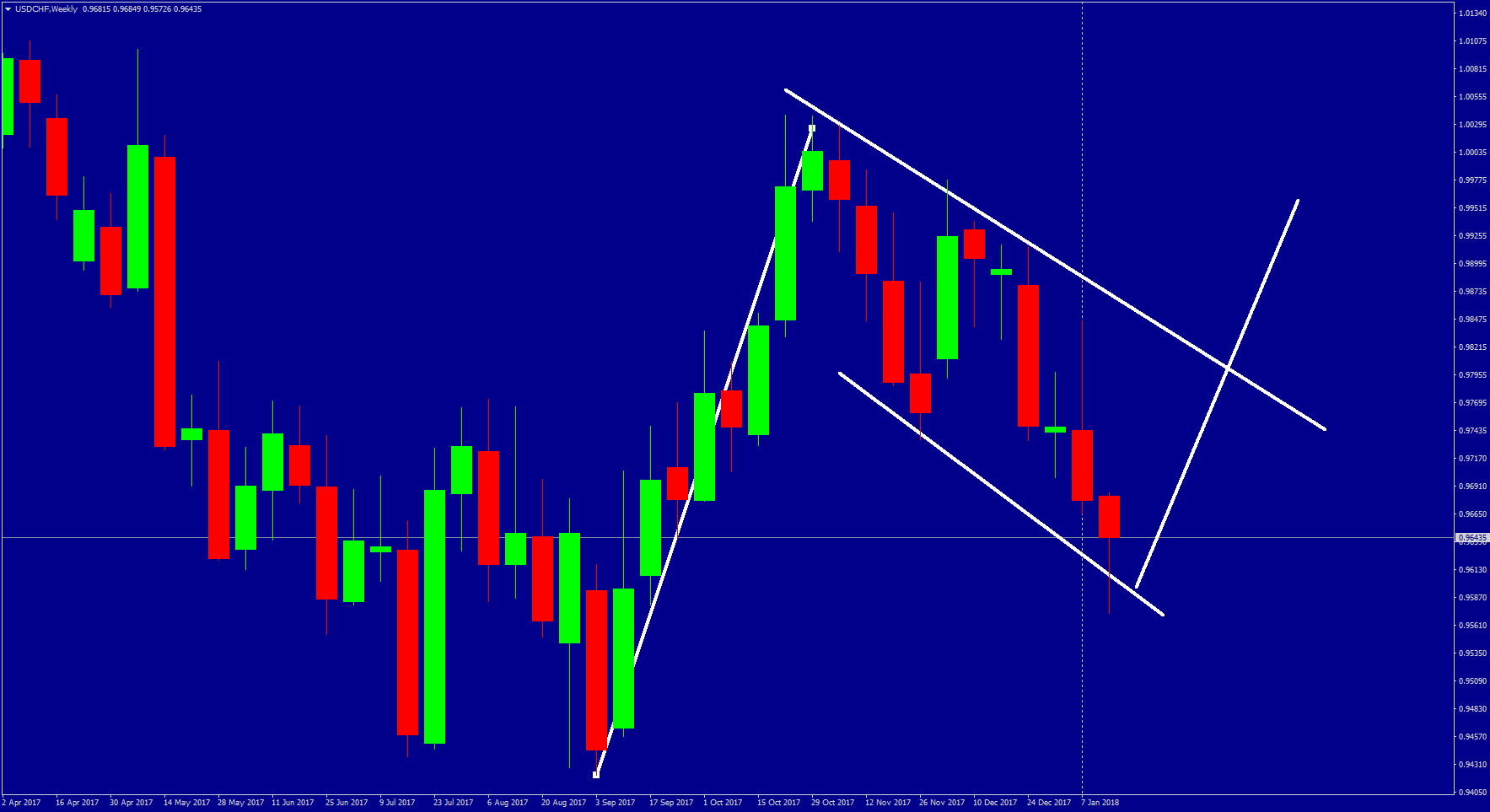

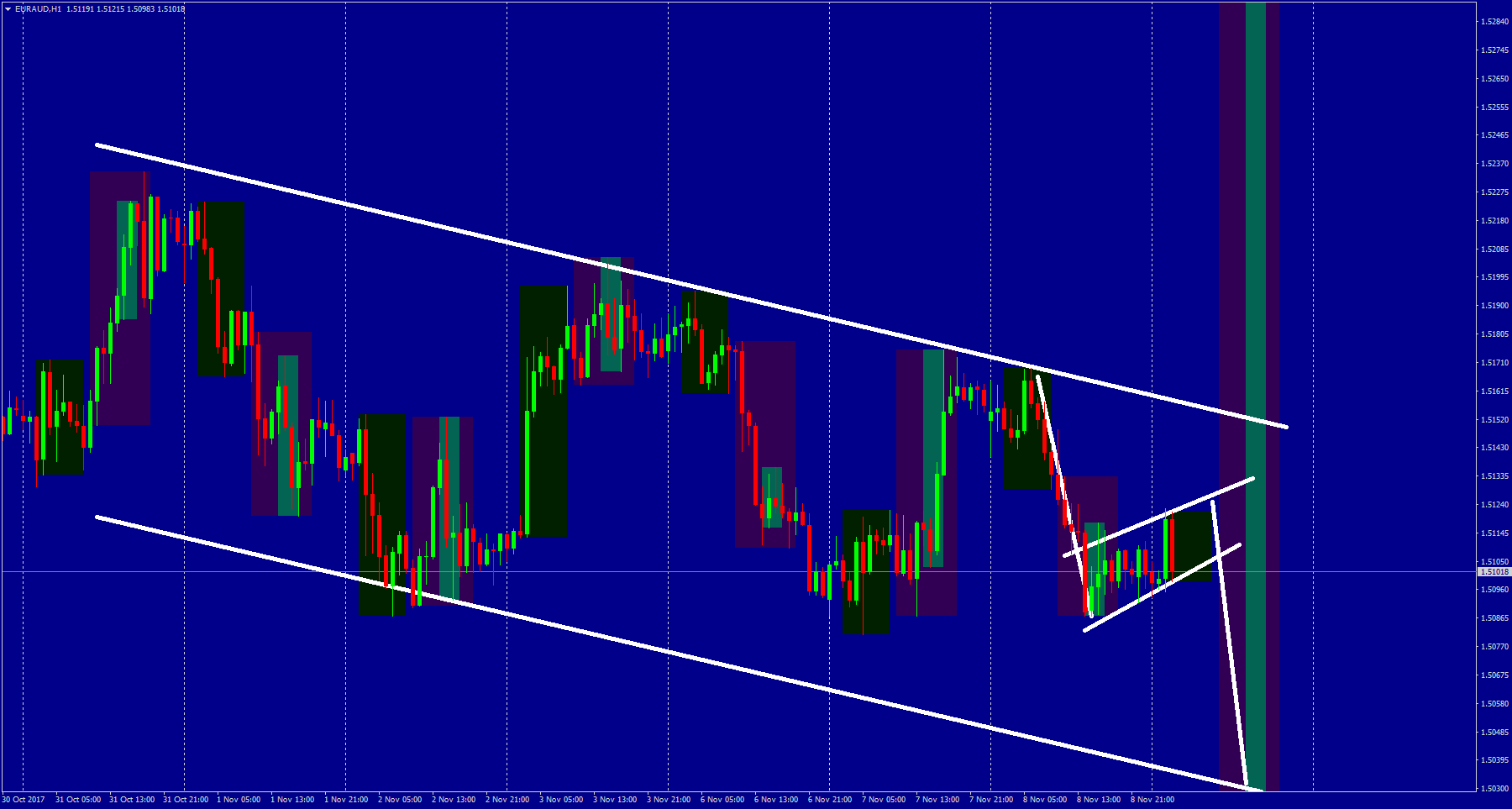

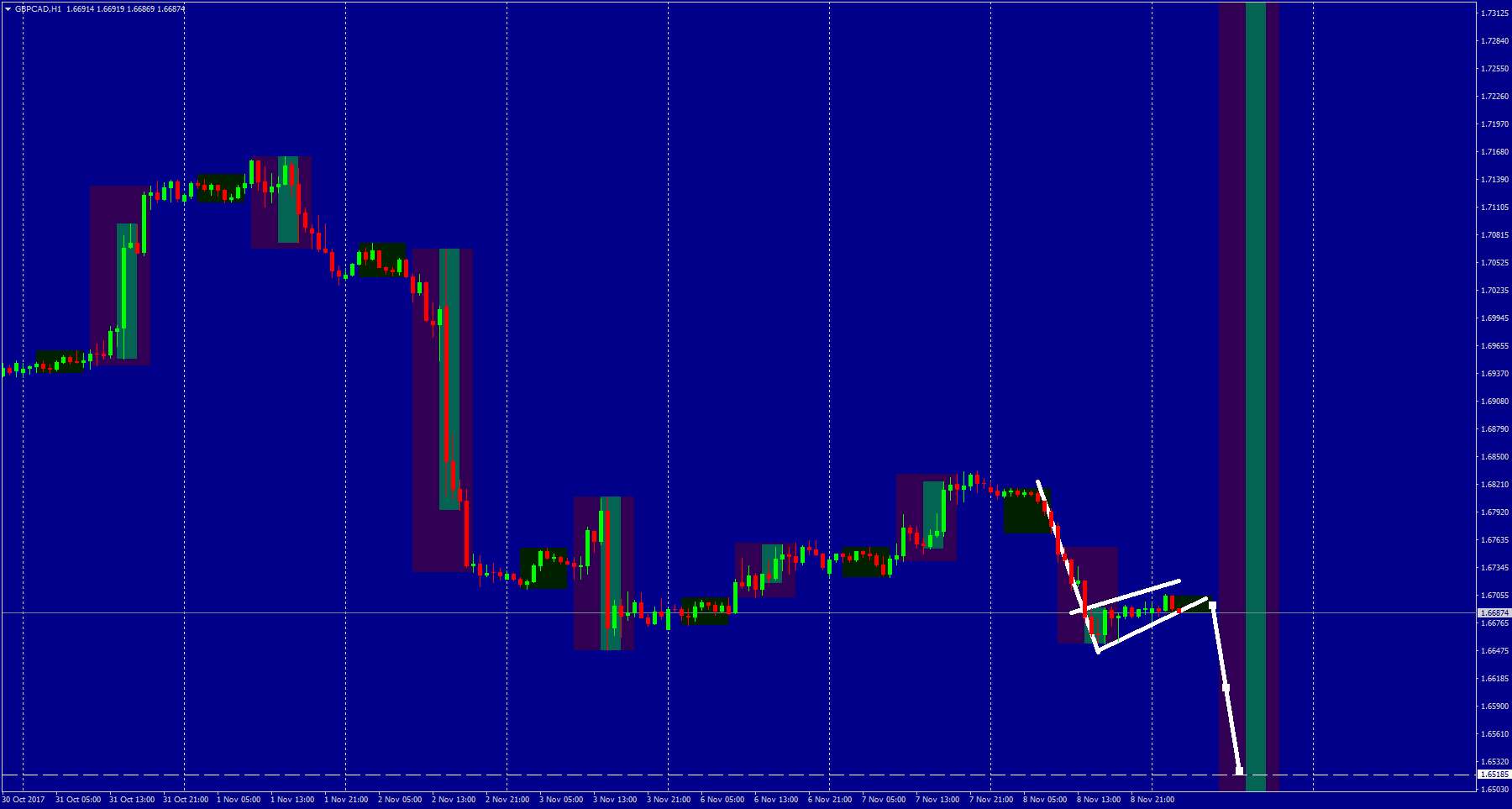

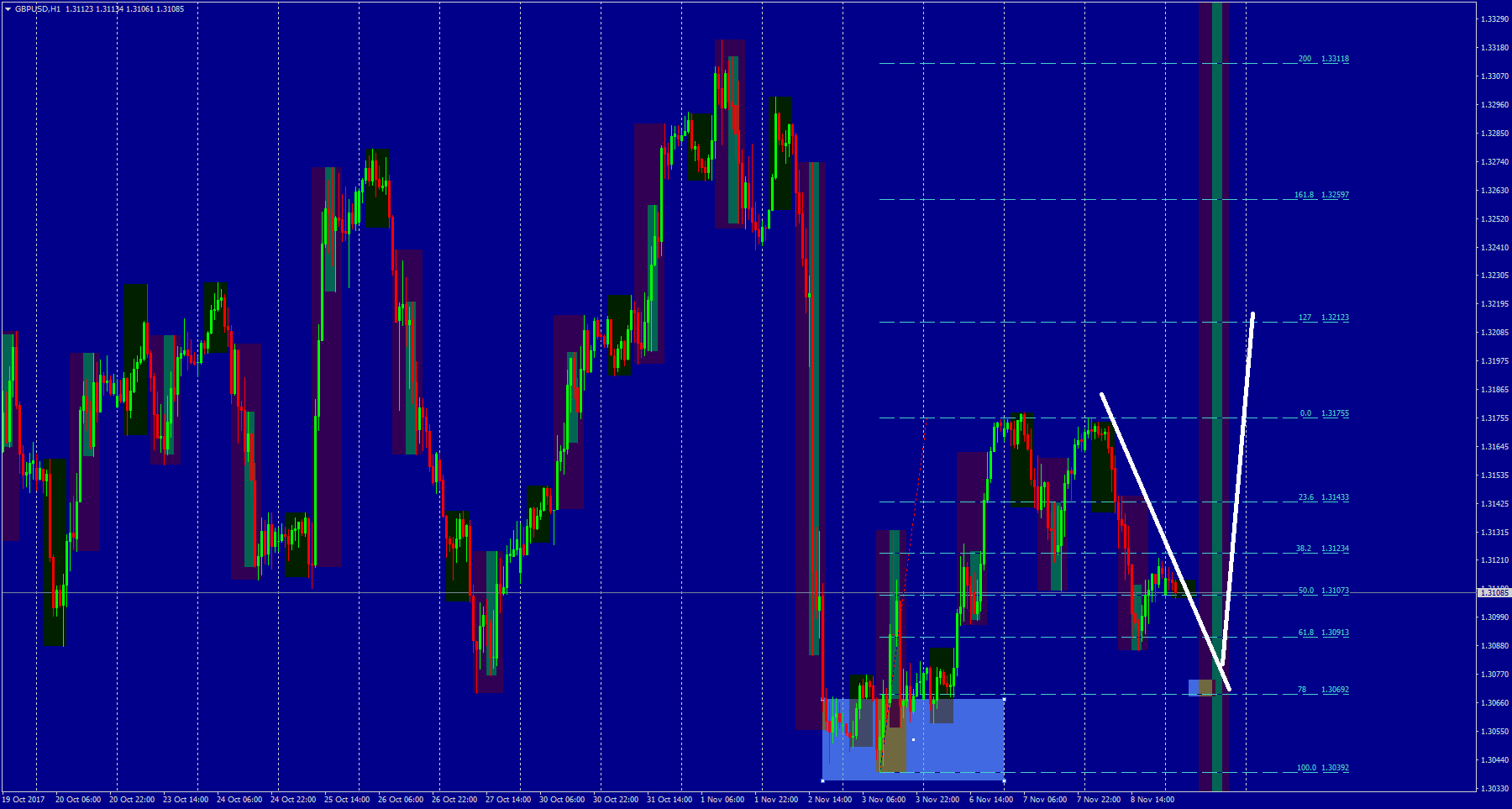

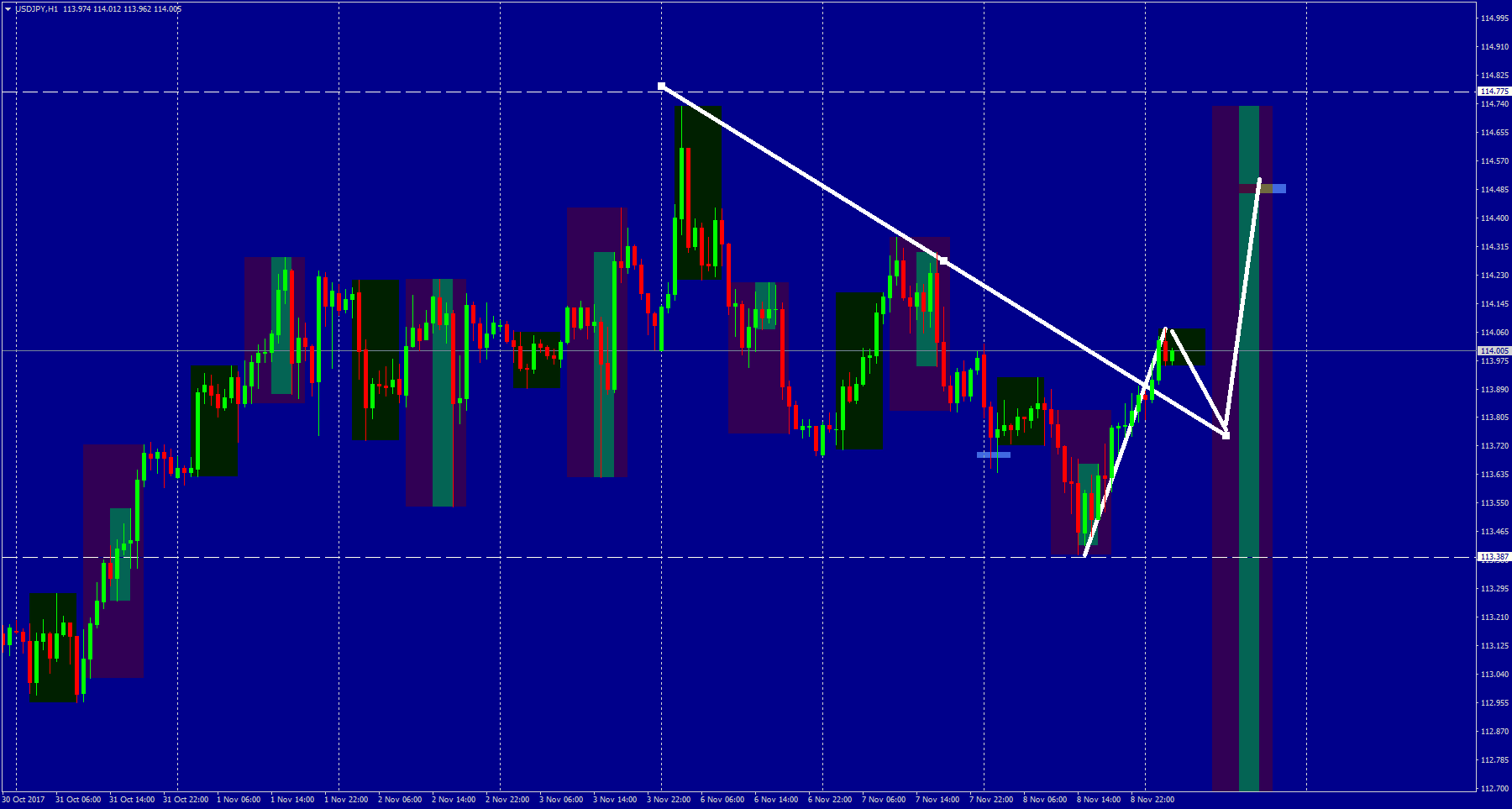

Today(Trade 2), I took the trade below (short). Upon entry the trade went down almost 50 pips before returning all the way to my entry in a bullish manner.

Even with experience on your side thoughts of uncertainty will occur. I took a moment to confirm my analysis and decided to continue my position as i saw there was room to the downside.

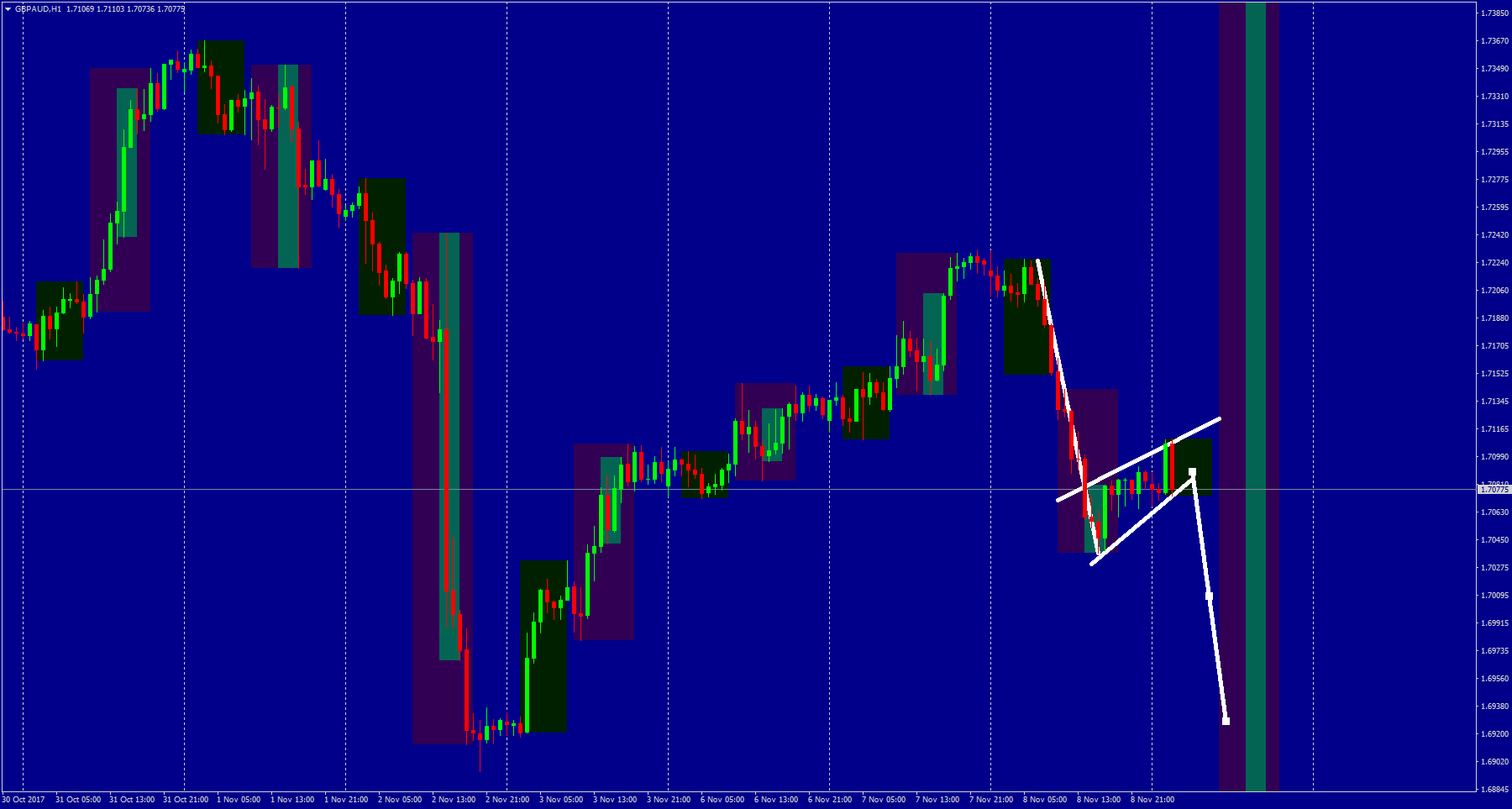

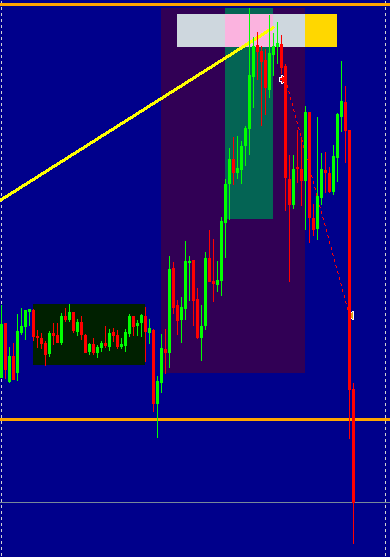

The momentum finally kicked in but moved too fast. I extended my profit target and secured my stop. Unfortunately, after a 25 tick retrace within a few seconds, my brain went in to a primitive mode. I closed out the trade at 52 pips. Which is great but as you can see below the trade went down for another 50+ pips straight after.

These moments make us re-evaluate our choices.

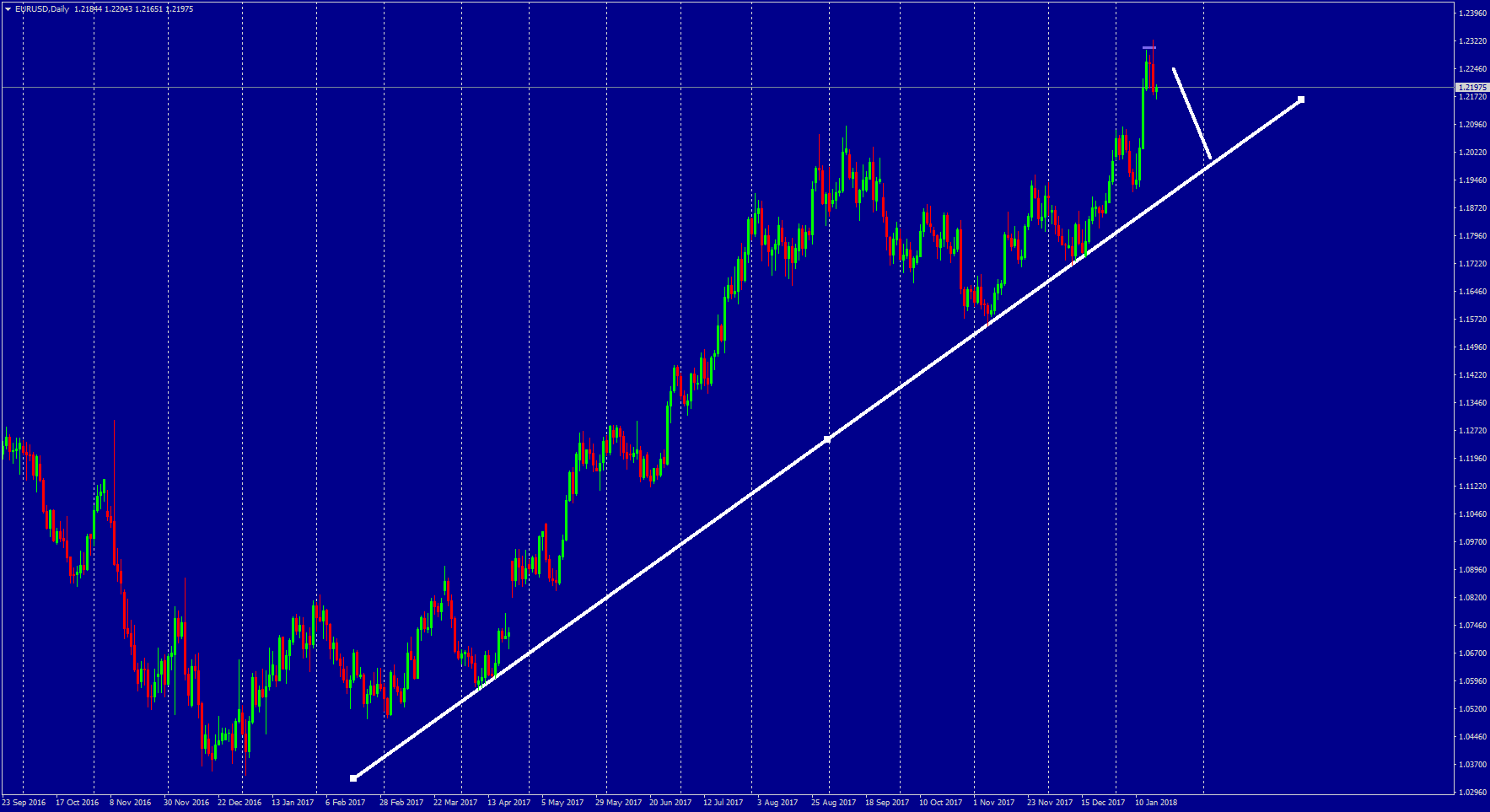

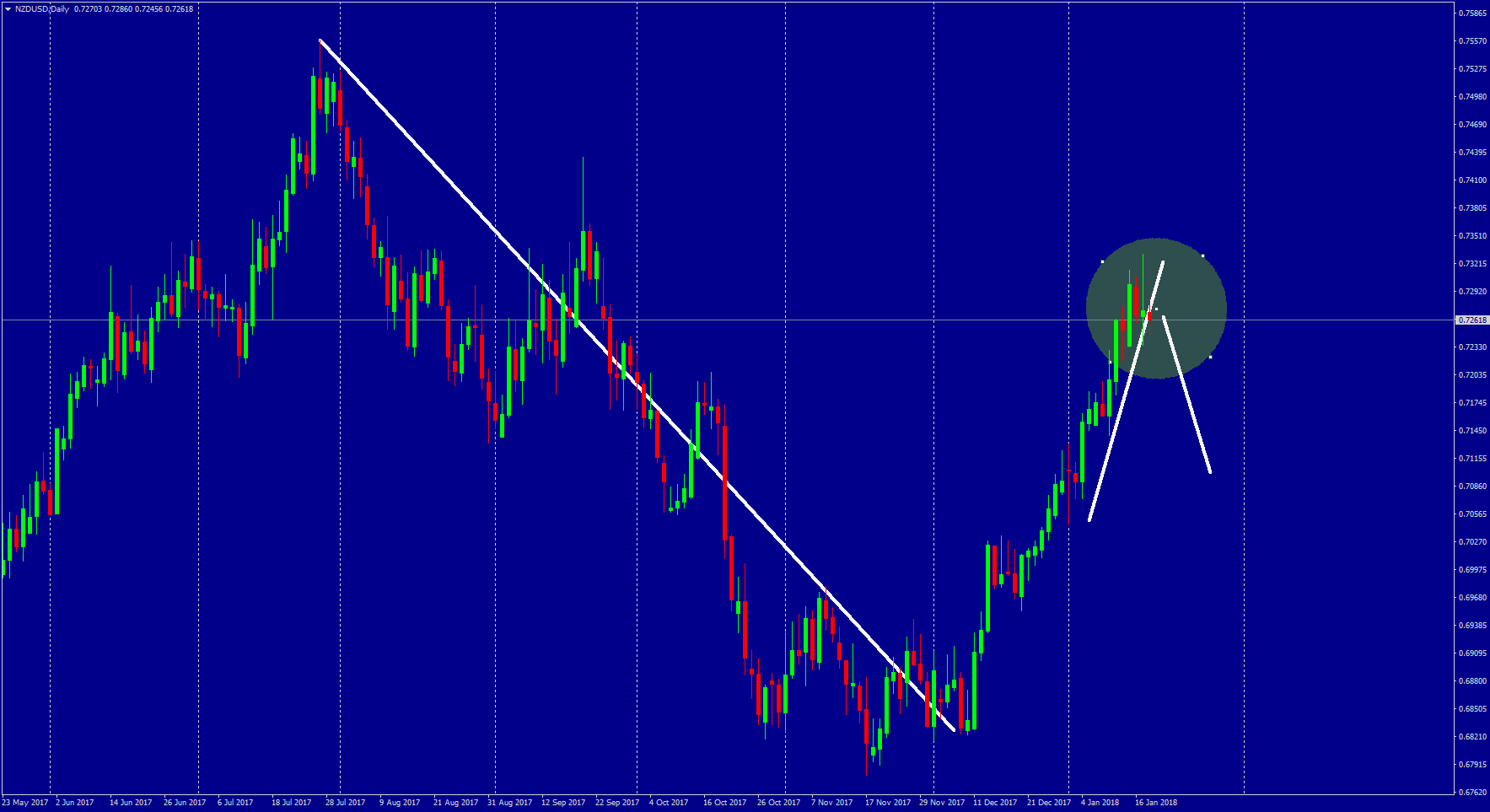

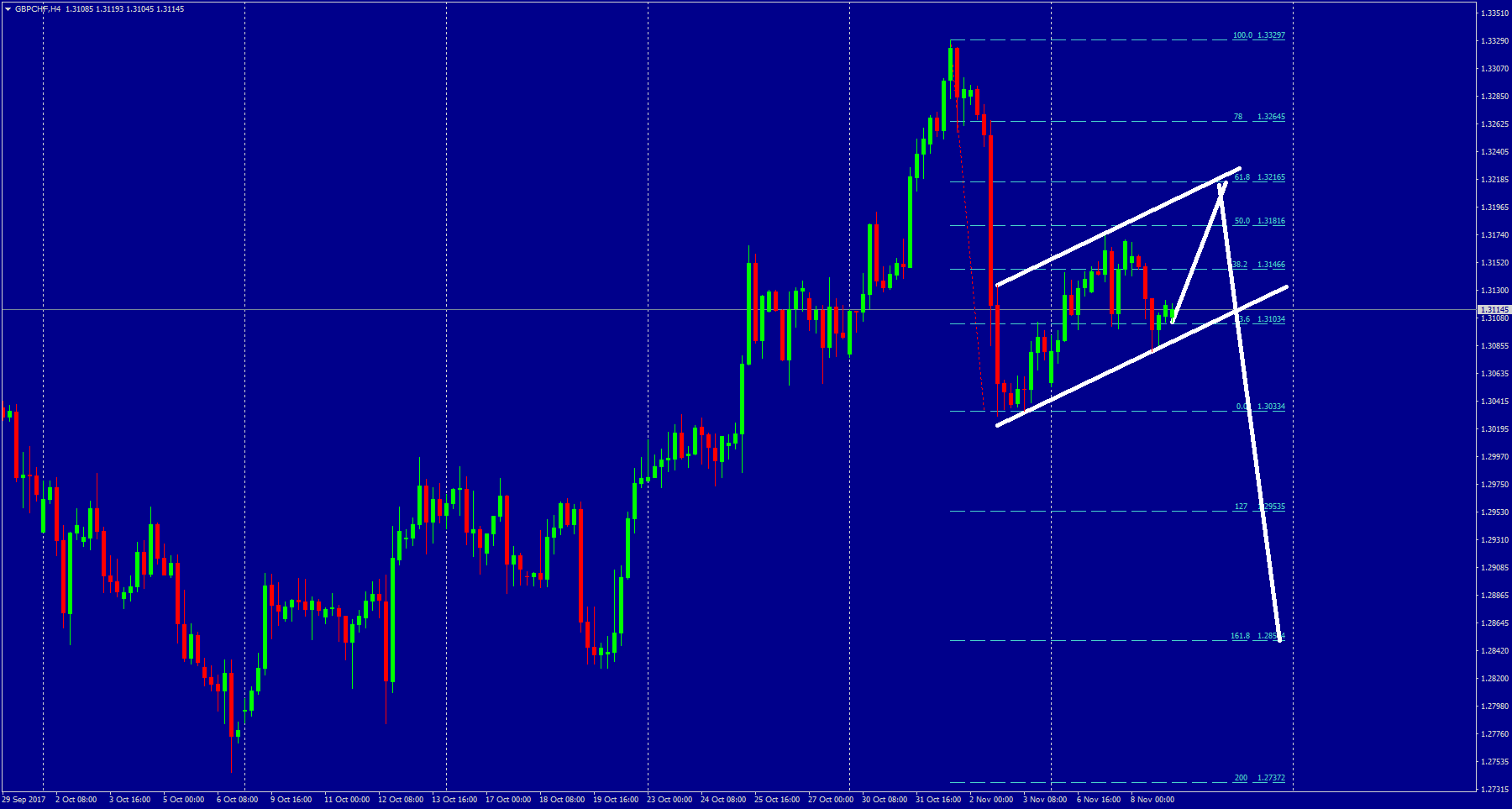

From Analysis:

Trade 1) Is this a small pullback and will go back to profit target?

Trade 2) Was my entry a pullback on a larger time frame and will the market continue to go up? Did the trade hit support and returning back to the top to stop me out?

To Personal:

Trade 1) Was I wrong? Did I see the market the complete opposite way? Should have made profit target smaller!

Trade 2) WHY did I exit so early?! I could have doubled my profit. Even though the trade was a 2:1 it could have been a 4:1 (greed)

This is where self-discipline and a strong mentality matters most. You see, no matter how much time you spend on analysis. A split decision action such as setting your profit target to a round number ($) or exiting a trade too early costs.

Sometimes we want to kick ourselves for making these mistakes. This is where you need to take a second and see what mental triggers are occurring. Whether it is anger from setting a stop or profit too tight and not maximizing the move. Or FOMO from missing out on a winning trade.

Understand: Time does not equal money. Winning trades can have as much mental strain as losing trades. The beautiful thing about the market is that every day is a new day and opportunity. Up, down, and sideways. Hindrances and mistakes will happen. Revenge trading or jumping back in unprepared will hurt more than it heals. Keep in mind self-discipline and forgive yourself for mistakes. As even the greatest person in every field makes mistakes or has an off day.

Trade 2